WAIT! DON'T MISS THIS

Before you go, want to learn these tax strategies for FREE? Join our free webinar where Ankur breaks down advanced tax strategies that could save you thousands.

"Ankur puts out really good content. He's one of my top three follows on X. Just very tactical and practical."

"Ankur came from nothing and sold a company for $250 million. If you are building something today, you will want to listen to him."

"Ankur's the man! He will teach you money tips nobody really teaches you. I could talk to him about anything but I want him to teach me about taxes."

Stop overpaying on your taxes with basic tax strategies...

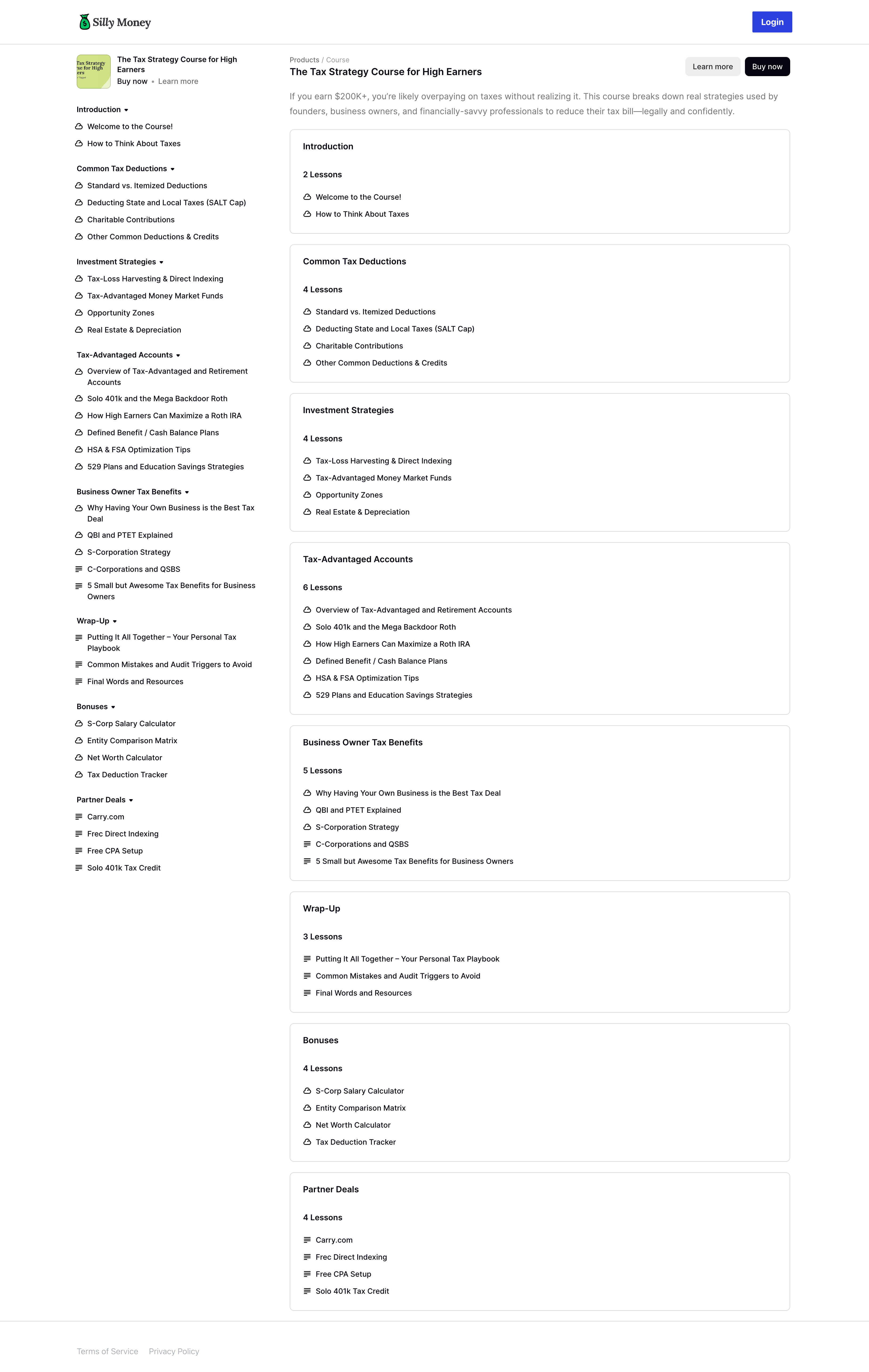

This masterclass shows you how advanced tax deductions and entity optimization strategies could potentially save you thousands in taxes, especially if you're a high-earning entrepreneur or business owner.

8+ comprehensive video lessons covering advanced deductions, entity structures, retirement strategies, and implementation tactics used by successful entrepreneurs

Complete tracking system for business expenses, receipts, and deductions to maximize your write-offs and ensure nothing gets missed

Visual guide to help you choose the optimal business structure (LLC, S-Corp, etc.) based on your income, goals, and tax situation

Calculate your optimal W-2 salary to minimize self-employment tax while staying IRS-compliant and preserving QBI deduction.

Complete tracking system for business expenses, receipts, and deductions to maximize your write-offs and ensure nothing gets missed.

Track your assets, liabilities, and overall financial position to measure your wealth building progress over time.

We've negotiated special discounts with trusted partners to help you implement the tax strategies

$270 Off

Get 12 months of access for just the typical one month's price

$500 Credit

Free professional tax pro setup plus $500 credit toward your first year services

$250 Credit

Low fee, direct indexing automation tool

$1,500 Total Credit

$500/year auto-enrollment tax credit for 3 years with Solo 401k setup

For years, I paid my accountant and hoped for the best. Basic deductions, standard advice, and a hefty tax bill every year.

After selling my last company for $250M+, I realized I needed to understand tax optimization at a deeper level.

That's when I dove deep into advanced strategies, entity structures, and optimization techniques.

Through research, working with top tax professionals, and implementing strategies across multiple businesses, I discovered that many people could cut their tax bill in half (or more!) through legal optimization.

I spent countless hours studying deduction strategies, entity structures, and IRS regulations to understand what was actually possible.

Now I want to share what I've learned so you don't have to spend years figuring this out on your own.

In this course, I'll teach you the advanced strategies and systems I've developed for tax optimization.

Many high earners work with CPAs and tax professionals, and that's great.

(In fact, if you don't have one, we'll even set you up with a professional for free and throw in a $500 credit on the first year working with them.)

But it's valuable to understand the strategies yourself first.

When you understand tax optimization, you can have better conversations with professionals and make more informed decisions.

This educational approach focuses on explaining the concepts and strategies developed through extensive research and experience.

You'll learn the knowledge gained through years of optimization so you can understand these strategies too.

This course is designed for self-employed individuals, business owners, freelancers, and high-income earners who want to learn advanced tax optimization strategies. If you're paying significant taxes and want to understand legal ways to reduce your tax bill, this course is for you.

Yes! We offer a 30-day satisfaction guarantee. We offer a 30-day satisfaction guarantee. Complete the course, and if you're not happy with what you learned, we'll refund your purchase. Refunds are not available if you haven't completed the course or have redeemed any partner deals.

I'm Ankur Nagpal, founder of Silly Money and the entrepreneur who sold my last business for $250M+. I've learned advanced tax optimization strategies through working with top tax professionals and implementing them across multiple businesses.

Silly Money is an educational platform focused on helping people make smarter financial decisions. We provide educational content about personal finance, taxes, and retirement planning strategies for entrepreneurs, professionals, and anyone looking to optimize their financial life.

While many strategies are most powerful for business owners and self-employed individuals, the course also covers tax optimization tactics for high-income W-2 earners. Entity structure optimization, retirement account strategies, and deduction planning work best with business income.

Tax savings vary significantly based on your income, business structure, and situation. In the course example, someone making $200,000 could potentially save $28,000+ annually through S-Corp election, Solo 401k contributions, and strategic deduction planning. Your results will depend on your specific circumstances.

For $199, you could get a nice dinner, some clothes, or a few hours with a CPA. But none of those will teach you the comprehensive strategies that could help you save tens of thousands in taxes year after year. This course is designed to pay for itself many times over with just one year of optimized tax planning.

No, this course is educational and designed to help you understand tax strategies better. You should still work with a qualified tax professional to implement these strategies. However, understanding these concepts will help you have better conversations with your CPA and ensure you're not missing valuable tax-saving opportunities.

We offer a 30-day satisfaction guarantee. Complete the course, and if you're not happy with what you learned, we'll refund your purchase. Refunds are not available if you haven't completed the course or have redeemed any partner deals.

*Disclaimers: This course is for educational purposes only and does not constitute tax, legal, or professional advice. Tax situations are highly individual and results will vary based on your specific circumstances, income, and tax bracket. Potential tax savings are estimates and not guaranteed. Please consult with qualified tax professionals before implementing any strategies.